CRO token – The Core of Crypto.com’s Ecosystem

When dealing with CRO token, the native utility token of the Crypto.com blockchain that powers fee discounts, staking rewards and payment options. Also known as Crypto.com Coin, it enables users to lower transaction fees and earn yields. Another key concept is crypto transaction confirmation time, the period a network takes to validate and finalize a transfer, which directly influences how quickly CRO moves between wallets. Then there’s the airdrop, a distribution method where free tokens are given to eligible participants; many CRO projects use it to grow their community. Finally, crypto tax, the legal obligation to report gains or losses from digital assets, which shapes how holders plan their CRO strategy.

Why transaction speed matters for CRO

Every time you send CRO, the network’s confirmation time decides whether the trade feels instant or sluggish. Faster confirmation means you can swap CRO for other assets on decentralized exchanges without waiting, which is crucial for day traders chasing arbitrage. Slower times can increase exposure to price swings, raising the risk of slippage. This is why many CRO users keep an eye on block times and fee structures – a higher fee often shortens the confirmation window, letting the transaction lock in at the intended price.

Airdrops have become a popular way to introduce new CRO‑based projects to the market. By handing out free tokens to existing CRO holders, creators spark immediate liquidity and community buzz. The process usually requires you to hold a minimum amount of CRO in a supported wallet, complete a few verification steps, and claim within a set window. Successful airdrops can lift the token’s visibility, drive up trading volume on platforms like Crypto.com Exchange, and even attract new investors who see the added utility.

But holding CRO isn’t just about freebies and fast swaps; tax implications are a real concern. In many jurisdictions, every CRO transaction – whether it’s a sale, a swap, or a reward from staking – creates a taxable event. Knowing the local crypto tax rate helps you decide when to claim airdrops or sell for profit. Some countries treat airdropped CRO as ordinary income at fair market value, while others consider it a capital gain only when you dispose of the tokens. Planning ahead can save you from surprise bills and keep your CRO strategy tax‑efficient.

The ecosystem around CRO also includes exchange reviews, safety checklists, and compliance guides. Choosing a reputable exchange ensures your CRO stays protected against hacks and that the platform follows AML/KYC rules, which in turn affects how smoothly you can move your tokens. Compliance tools, such as transaction monitoring software, help both users and businesses stay on the right side of regulation, especially when dealing with large CRO‑based DeFi positions.

All these angles – from speed and airdrops to taxes and exchange safety – shape the way CRO is used today. Below you’ll find a curated set of articles that walk through transaction mechanics, airdrop claims, tax reporting tips, and platform reviews, giving you the practical knowledge to make the most of your CRO holdings.

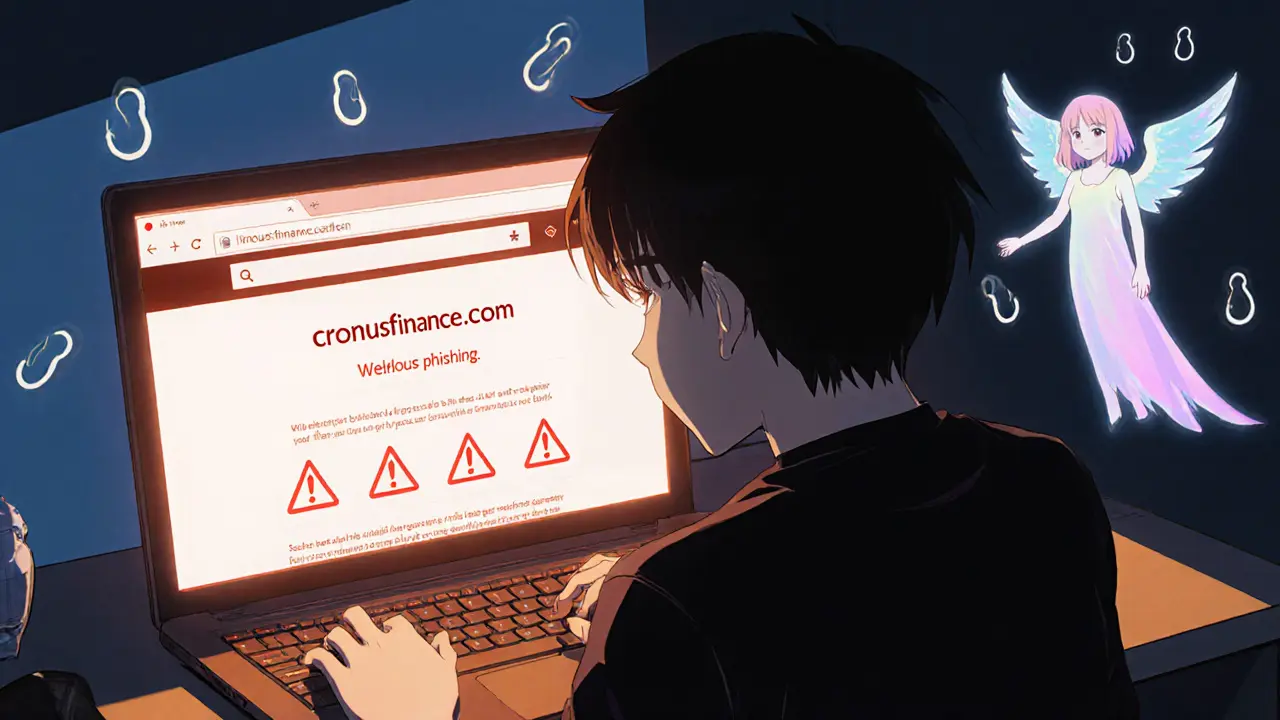

Cronus Finance Crypto Exchange Review - Scam Alert & Crypto.com Comparison

Discover why "Cronus Finance" is a scam, learn about the real Crypto.com/Cronos platform, compare top exchanges, and get safety tips for trading CRO.