Cronus Finance Review: What You Need to Know Before You Jump In

When evaluating Cronus Finance, a decentralized finance platform that offers yield farming, staking, and liquidity mining services. Also known as Cronus, it aims to combine high APYs with a user‑friendly dashboard. DeFi, the broader ecosystem of blockchain‑based financial services provides the backdrop, while smart contracts, self‑executing code that governs token swaps and reward distribution power the core mechanics.

Cronus Finance encompasses a range of yield farming strategies, meaning users lock assets into liquidity pools to earn rewards. These pools require robust smart contract security because any vulnerability can lead to fund loss. That’s why a diligent smart contract audit becomes a key factor; auditors assess code quality, check for re‑entrancy bugs, and verify that reward formulas work as intended. In practice, the platform’s tokenomics are tied to its native token, which fuels governance and fee distribution. Understanding how token supply, inflation rates, and vesting schedules interact helps users gauge long‑term profitability.

Key Entities and How They Interact

Three core entities shape the Cronus Finance experience: the platform itself, its liquidity pools, and the community governance model. The platform offers multiple pool types—stable‑coin farms, cross‑chain farms, and leveraged farms—each with different risk‑reward profiles. Liquidity pools influence market depth and price stability for the assets they hold, while governance tokens enable token holders to vote on fee structures, new farm launches, and audit funding. This triad creates a feedback loop: better pools attract more liquidity, which boosts governance participation, leading to more refined platform upgrades.

Another important relationship is between Cronus Finance and the broader DeFi landscape. As a DeFi platform, Cronus relies on interoperability with major blockchains like Ethereum and Binance Smart Chain. Cross‑chain bridges allow users to move assets without leaving the Cronus interface, expanding the pool of potential participants. At the same time, the platform’s reputation hinges on how well it follows industry best practices, such as third‑party audits and transparent fee disclosures. These practices affect user confidence and ultimately drive the volume of liquidity mining.

Security is the linchpin of any DeFi service. Cronus Finance’s smart contracts undergo periodic audits by firms specializing in formal verification. The audit reports detail findings, remediation steps, and a risk rating. For a user, the audit status is a quick gauge of how safe the platform’s code is. Additionally, the platform implements an emergency pause function, giving the team the ability to halt operations if a critical vulnerability is discovered. This safety net mitigates potential exploits and protects user funds during unforeseen events.

From a user perspective, the decision to stake on Cronus Finance should consider both the reward rates and the underlying risks. High APYs often come with higher exposure to impermanent loss, especially in volatile asset pairs. Users can lower this risk by choosing stable‑coin farms or by diversifying across several pool categories. Calculating expected returns involves looking at the pool’s total value locked (TVL), current reward emission, and the token’s market price. Many community tools provide real‑time calculators that factor in these variables, helping users make informed choices.

Finally, community involvement plays a pivotal role. Cronus Finance runs regular AMA sessions, governance proposal discussions, and bounty programs that reward users for finding bugs or suggesting improvements. This collaborative approach not only enhances platform security but also builds a loyal user base. By participating in governance votes, users directly shape the platform’s future roadmap, from adding new farm types to adjusting fee structures.

All of these pieces—platform features, liquidity dynamics, security audits, and community governance—combine to form the full picture of what a Cronus Finance review really means. Below you’ll find a curated collection of deep‑dive articles that break down each element, from transaction speed and confirmation times to real‑world case studies of yield farming performance. Dive in to see how the platform stacks up against other DeFi contenders and get the practical insights you need before you lock your assets.

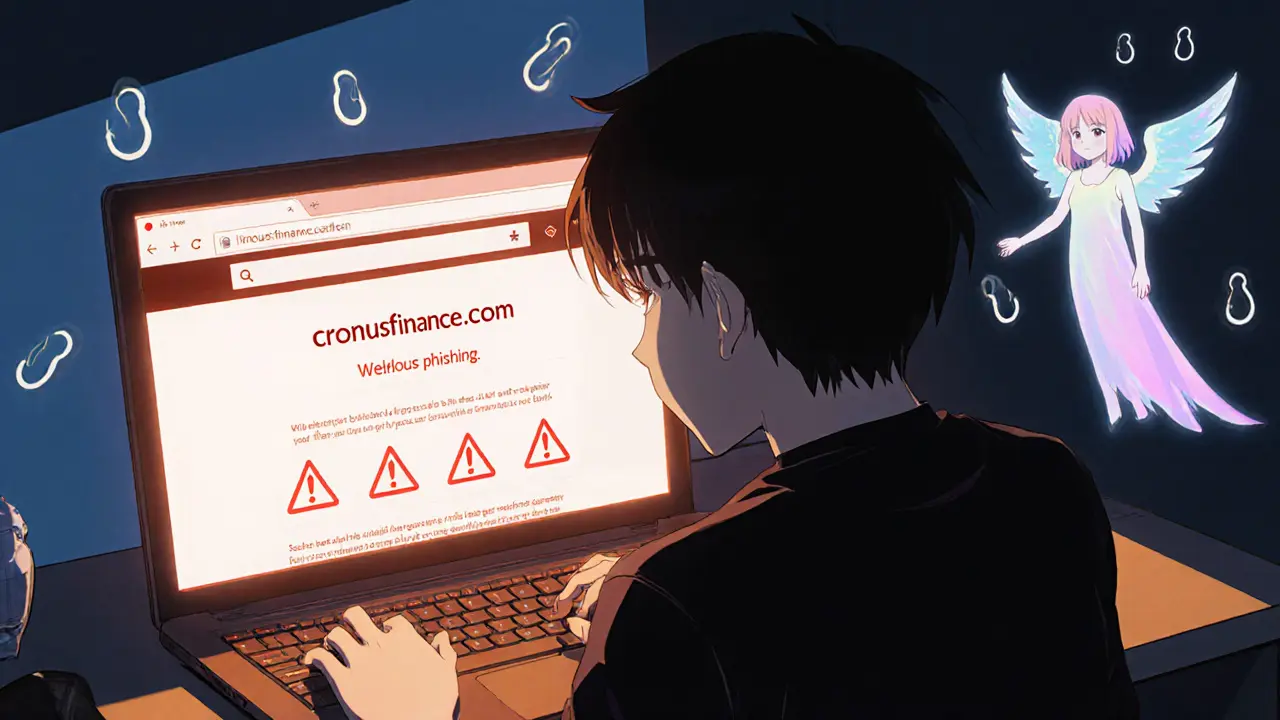

Cronus Finance Crypto Exchange Review - Scam Alert & Crypto.com Comparison

Discover why "Cronus Finance" is a scam, learn about the real Crypto.com/Cronos platform, compare top exchanges, and get safety tips for trading CRO.