Crypto Exchange Scam: Spotting Fraud and Protecting Your Funds

When dealing with crypto exchange scam, a fraudulent platform that pretends to be a legitimate cryptocurrency trading service to steal users’ assets. Also known as exchange fraud, it often mixes phishing attacks with fake exchange reviews to lure unsuspecting traders.

Why Scams Keep Growing

Scammers love the hype around new tokens and DeFi projects. They create a crypto exchange that mirrors a popular platform, copy logos, and even paste real‑time price charts. crypto exchange scam thrives because users assume a slick UI means safety. The trick is simple: convince you to deposit, then disappear. The more hype, the bigger the crowd they can trap.

Three core ideas link together here: crypto exchange scams encompass phishing attacks, detecting scams requires security tools, and regulatory oversight influences exchange safety. Those triples set the stage for practical protection steps. If you understand how each piece fits, you can break the scam’s chain before it starts.

First, recognize the red flags a fake exchange throws at you. Look for mismatched URLs, missing SSL certificates, or unusually high referral bonuses. Real platforms rarely promise guaranteed returns. When a site asks for your private key or seed phrase, that’s a dead‑end. The moment you see a request for full wallet access, treat it as a phishing attack and walk away.

Second, verify the exchange through independent channels. Search the financial regulator or local crypto watchdog for a licensing list. If the exchange isn’t listed, that’s a strong warning sign. Many countries publish blacklists of known fraudulent platforms; a quick check can save thousands.

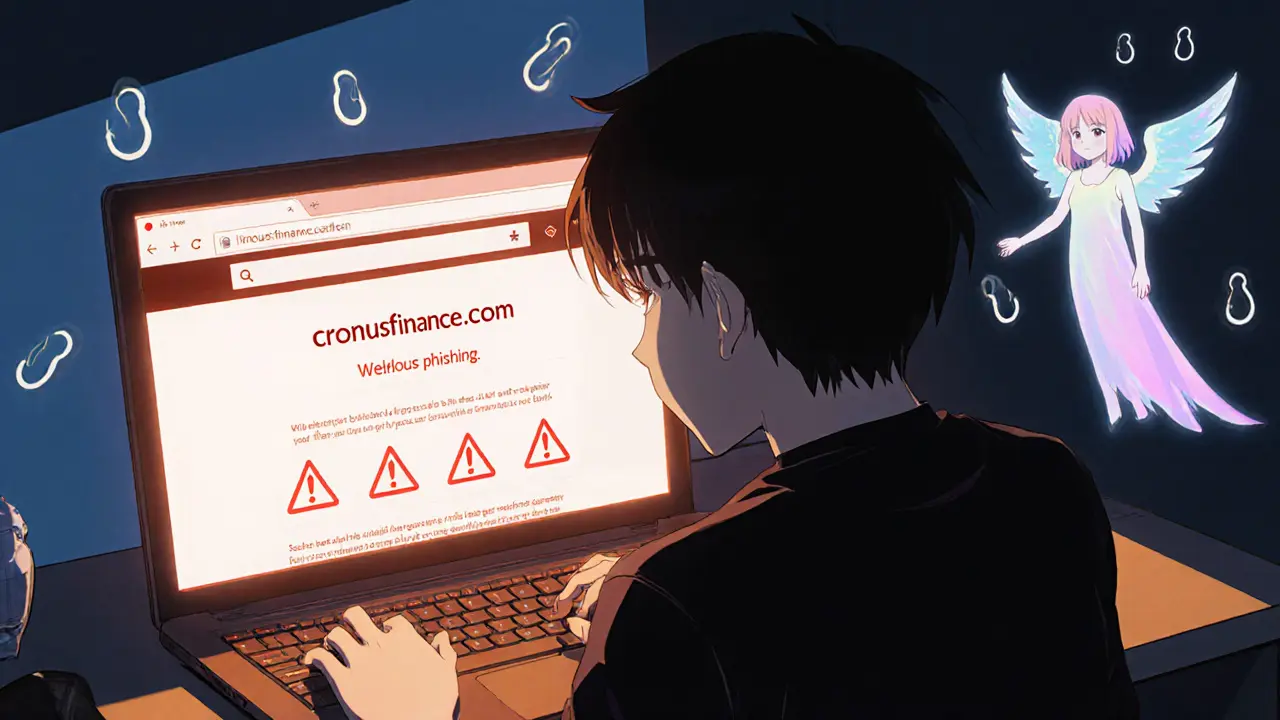

Third, use security tools that flag suspicious domains. Browser extensions that highlight known phishing sites, DNS filtering services, and crypto‑focused anti‑phishing bots add an extra layer of defense. Even a basic tool that checks the SSL certificate’s issuer can reveal a fake setup within seconds.

Scammers also weaponize fake reviews. They flood forums and social media with praising comments, often using bots to boost credibility. A genuine community will have a mix of positive and critical feedback, not a chorus of perfect praise. Dive into the comment history—look for repetitive phrasing or accounts created days ago.

Finally, keep your assets off‑exchange whenever possible. Store long‑term holdings in hardware wallets or secure software wallets where you control the private keys. Use exchanges only for short‑term trading, and withdraw profits promptly. By limiting the amount you leave on any platform, you reduce the potential loss from a scam.

Below you’ll find a curated list of articles that break down each of these points in detail. From deep dives into phishing mechanics to step‑by‑step guides on checking regulatory status, the collection gives you actionable insights to stay ahead of fraudsters. Let’s dive into the resources and arm yourself with the knowledge you need to trade confidently.

Cronus Finance Crypto Exchange Review - Scam Alert & Crypto.com Comparison

Discover why "Cronus Finance" is a scam, learn about the real Crypto.com/Cronos platform, compare top exchanges, and get safety tips for trading CRO.