DeFi Yield Optimizer Calculator

How It Works

This calculator shows potential yields from combining DeFi protocols while highlighting risks based on the number of connections. By November 2025, the TVL in composability-focused protocols hit $23.5 billion, but remember: the more you connect, the more risk you introduce.

Potential Results

Aave (Lending)

APY Range: 4.2% - 12.7%

TVL: $13.2B (Nov 2025)

Uniswap (Dex)

Trading Fees: 0.01% - 0.3%

TVL: $8.4B (Nov 2025)

Lido (Staking)

APY: 3.8% - 5.1%

TVL: $6.7B (Nov 2025)

Yearn (Yield Aggregator)

APY Range: 6.5% - 18.3%

TVL: $3.1B (Nov 2025)

Imagine building a financial product not from scratch, but by snapping together existing pieces like LEGO blocks. That’s DeFi composability - and by 2025, it’s no longer a niche experiment. It’s the engine driving most of the innovation in decentralized finance. You don’t need to code a new lending platform if you can plug into Aave. You don’t need to build your own liquidity pool if Uniswap already has one. You just connect them, add a dash of staking, and suddenly you’ve created a yield strategy that didn’t exist six months ago.

What Exactly Is DeFi Composability?

DeFi composability means protocols can talk to each other directly through smart contracts. It’s not just API calls or data sharing - it’s one program calling another like a function in code. This works because everything runs on open, permissionless blockchains, mostly Ethereum and its layer-2s. Protocols follow standard interfaces like ERC-20 for tokens or ERC-721 for NFTs. When a protocol like Lido lets you stake ETH and get stETH in return, that stETH can then be used as collateral on Aave, swapped on Uniswap, or locked into a yield aggregator like Yearn. Each step happens automatically, without intermediaries.

That’s the power: DeFi composability turns financial services into reusable components. Developers don’t reinvent the wheel. They rearrange existing ones. This is why new DeFi products can launch in days instead of months. In traditional finance, integrating a new payment system with a bank’s clearinghouse takes legal teams, compliance audits, and months of testing. In DeFi, a developer can combine three protocols in a weekend.

How Composability Is Driving Real Results

By November 2025, the total value locked (TVL) in protocols designed for composability hit $23.5 billion. That’s not just a number - it’s proof that users and developers are betting big on this model. The most composed protocols? Uniswap, Aave, and Curve Finance. They’re the foundation. Over 83% of top DeFi apps rely on at least one of them as a base layer.

Take yield optimization. A user might stake ETH with Lido to get stETH, deposit stETH into Aave to earn interest, then use that interest-bearing position as collateral in a leveraged position on Morpho. All of this happens in a single transaction chain. Pantera Capital found this approach cuts transaction costs by 37% compared to isolated systems. Capital efficiency jumps because the same asset isn’t sitting idle - it’s working across multiple protocols at once.

AI is now stepping in to manage these complex stacks. Platforms like GoMining use machine learning to auto-adjust user positions based on market volatility. Their users see 22% higher yields than those manually tweaking their portfolios. That’s not magic - it’s smart automation built on composability.

The Dark Side: When LEGO Towers Collapse

But here’s the catch: when everything connects, one broken piece can bring down the whole structure.

The 2022 Euler Finance exploit is a textbook case. A vulnerability in one lending protocol allowed attackers to drain funds - but because that protocol was used as collateral in seven other DeFi apps, the damage spread like wildfire. Over $200 million was lost across interconnected platforms. Then came Terra/Luna in 2023. Its collapse wiped out $40 billion in DeFi value in under 72 hours because so many protocols held its UST stablecoin or LUNA token as collateral.

Chainalysis reports that between 2022 and 2023, combinatorial risk caused $2.8 billion in losses. That’s not just bad luck - it’s systemic. The more protocols you link, the more attack surfaces you create. And most users don’t understand the risks. A Reddit user lost $1,843 in ETH trying to combine leveraged farming with liquid staking. When volatility spiked, the system auto-liquidated their position. They didn’t realize one protocol’s liquidation trigger could activate another’s.

Even experienced users struggle. Gitcoin data shows developers spend nearly half their time debugging multi-protocol failures. One small typo in a contract call can cause a cascade. Documentation varies wildly. Aave and Uniswap have excellent docs (92% and 87% satisfaction). Newer protocols? Only 63%.

Who’s Using It - And Who’s Scared?

There’s a clear divide between users. In a survey of 1,243 DeFi users on Reddit, 78% said composability unlocks yield opportunities impossible in traditional banking. One user reported a consistent 12.7% APY by combining liquid staking, lending, and rebalancing bots. That’s more than most savings accounts pay - and it’s automated.

But 63% of negative reviews on DappRadar blame complexity. Beginners get overwhelmed. Trustpilot ratings for aggregators like 1inch sit at 3.8/5 - praised for convenience, criticized for hiding risks. The same user who loves the 12.7% APY might not realize they’re exposed to three different smart contract risks, two oracle feeds, and a cross-chain bridge.

Survey data from Lunar Strategy shows 68% of experienced users see composability as essential. But 82% of newcomers find it intimidating. That gap is growing. The barrier to entry isn’t just technical - it’s psychological. You’re not just learning how to use an app. You’re learning how to navigate a financial ecosystem where every action has ripple effects.

The Next Evolution: Intent-Based DeFi

The next big leap isn’t more protocols - it’s simpler interfaces. Enter intent-based systems. Instead of telling a bot to “deposit 1 ETH into Aave, swap 0.5 ETH for stETH on Uniswap, and stake stETH on Lido,” you just say: “Maximize my ETH yield over the next 30 days with low risk.”

Platforms like BlockApex and SUAVE handle the rest. They analyze dozens of protocol combinations in real time, pick the safest and most profitable path, and execute it. Optimism’s case study showed this reduces user errors by 63%. That’s huge. It turns composability from a developer’s playground into something regular people can use.

And it’s not just about ease. It’s about safety. These systems can build in circuit breakers - if a protocol’s health score drops below a threshold, the intent engine pauses or reroutes your funds. This is how institutions will finally enter DeFi. Gartner predicts that by 2027, 65% of institutional DeFi participation will come through curated, risk-monitored composability stacks.

Regulation Is Catching Up

Composability’s wild west days are ending. The EU’s MiCA framework, effective since December 2024, now requires DeFi aggregators to perform “combinatorial risk assessments.” They must map out how their integrated protocols affect each other - and prove they can contain failures.

In the U.S., the SEC has launched 17 enforcement actions against DeFi platforms since early 2024, mostly targeting aggregators that bundle lending, staking, and trading into one product. Regulators see this as an unregistered security offering. The line is blurry: Is a yield strategy a product? Or is it just a user’s choice of protocols?

But regulation isn’t killing composability - it’s shaping it. The smartest projects are now building compliance into their architecture. Think of it like a firewall inside the smart contract: if a protocol gets flagged by regulators, the system automatically disconnects from it.

Real-World Assets Are the Next Frontier

Right now, DeFi is mostly crypto-native. But the real game-changer is bringing real-world assets (RWAs) onchain. Think corporate bonds, real estate tokens, or invoice financing. The potential? $16 trillion in capital.

Companies like Deloitte report that 41 Fortune 500 firms are now testing RWA-DeFi stacks. A bank might tokenize a $50 million loan, then use it as collateral in a DeFi lending pool. That loan could then be bundled into a structured product sold via a DeFi aggregator. All of it built on composability.

That’s the flywheel: more assets onchain → more protocols to use them → more users → more innovation. Ark Invest compares this to the SaaS boom - where specialized tools (like Slack, Zoom, Notion) got bundled into all-in-one platforms. DeFi will follow the same path. You won’t use ten different apps. You’ll use one, and behind the scenes, it’s stitching together a dozen protocols.

What Comes Next?

By 2027, DeFi composability will look very different:

- 90% of retail users will interact with DeFi through intent-based interfaces, not raw smart contracts.

- Composability will be the default, not the exception - every new DeFi app will be designed to plug into existing ones.

- Security audits will shift from single protocols to full stack analyses.

- Modular account abstraction (like ERC-4337) will let users set custom risk rules - “Only allow collateral from protocols with >$1B TVL.”

- DeFi’s share of global financial transactions could jump from 0.3% to 2.7% by 2030.

The future isn’t about more protocols. It’s about smarter combinations. It’s about making the complex invisible to the user - while keeping it transparent and secure for the system.

Should You Use It?

If you’re a developer: learn Solidity, study the top 5 composability patterns, and read the GitHub repos like DeFi-Curated. There are over 3,800 verified integration examples. Start small - connect one protocol to another. Test it. Break it. Fix it.

If you’re a user: start with trusted aggregators. Avoid leveraged positions until you understand liquidation mechanics. Never put more than you can afford to lose into a complex yield stack. And always ask: “What happens if one of these protocols fails?”

Composability isn’t just the future of DeFi. It’s the future of finance - permissionless, efficient, and terrifyingly powerful. The question isn’t whether it will succeed. It’s whether we can build the guardrails in time.

What does DeFi composability actually mean?

DeFi composability means decentralized finance protocols can interact directly with each other through smart contracts, like snapping LEGO blocks together. For example, you can stake ETH on Lido, use the resulting stETH as collateral on Aave, and then trade it on Uniswap - all without leaving the blockchain. This lets developers build new financial products by combining existing ones instead of coding from scratch.

Why is DeFi composability risky?

The biggest risk is combinatorial risk - when one protocol fails, it can trigger chain reactions across connected systems. The 2022 Euler Finance exploit and the 2023 Terra/Luna collapse both showed how a single vulnerability can wipe out billions because so many protocols rely on each other. Most users don’t realize they’re exposed to multiple smart contract risks at once.

Is DeFi composability better than traditional finance?

Yes, for speed and innovation. In traditional finance, integrating two financial services can take months of legal and technical work. In DeFi, developers can connect protocols in days - or even hours. But traditional finance wins on stability, regulation, and user protection. DeFi offers higher yields and more flexibility, but with far more risk.

What’s the difference between DeFi and CeFi composability?

CeFi (centralized finance) platforms like Coinbase control their systems tightly. They can integrate new features, but it takes them an average of 147 days because they need internal approvals, audits, and compliance checks. DeFi protocols are open and permissionless - anyone can connect to them. That’s why DeFi innovation is 30x faster, but also why risks spread faster.

How do I safely use DeFi composability?

Start with trusted platforms like Aave, Uniswap, or Curve. Use aggregators like 1inch or Matcha that simplify multi-protocol actions. Avoid leveraged positions until you understand liquidation triggers. Never put more than you can afford to lose into complex yield stacks. Always check the TVL and audit status of each protocol you interact with. And remember: if it sounds too good to be true, it probably is.

Will DeFi composability survive regulation?

Yes, but it will change. The EU’s MiCA law and SEC enforcement actions are pushing DeFi to build risk controls into protocols - like automatic disconnections if a partner fails compliance. The future isn’t unregulated chaos. It’s structured openness: protocols that stay connected only if they meet safety standards. Institutions are already preparing for this - 65% of institutional DeFi activity by 2027 will use curated, monitored composability stacks.

Mani Kumar

December 2, 2025 AT 17:24 PMComposability is not innovation-it’s architectural laziness. Building on top of unstable, unaudited primitives is not a feature, it’s a liability dressed as progress. The 2022 Euler exploit wasn’t an anomaly; it was inevitable. If you can’t audit the entire stack, you shouldn’t be touching it.

Tatiana Rodriguez

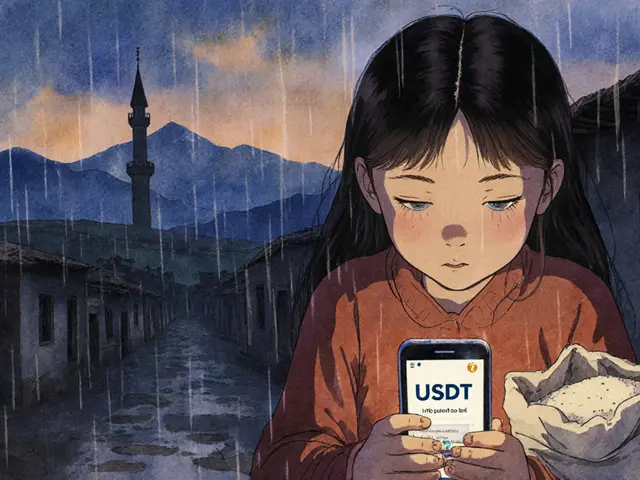

December 3, 2025 AT 11:51 AMOH MY GOD. I just spent 12 hours trying to optimize my stETH yield stack and I cried when the liquidation bot ate my 0.8 ETH because one protocol had a 0.0003% slippage tolerance I didn’t see in the UI?? Like, I’m not a dev, I just want to grow my money without feeling like I’m playing Russian roulette with smart contracts. But ALSO?? It’s the most thrilling thing I’ve ever experienced. I feel like a wizard. A very anxious wizard who checks Etherscan every 17 minutes. 🧙♀️💔

Philip Mirchin

December 5, 2025 AT 04:02 AMMan, I’ve been in crypto since 2017 and I’ve seen the hype cycle spin faster than a DeFi yield farm. But this? This is real. I’m from Chicago, and I’ve watched my cousin in Bangalore build a yield strategy using Lido + Aave + Curve that outperforms his bank’s CD by 8x. No middlemen. No paperwork. Just code. It’s not perfect, but it’s the first time finance actually felt… fair. Keep building, devs. We need this.

justin allen

December 6, 2025 AT 22:57 PMSo let me get this straight-you’re glorifying a system where a bunch of anonymous devs on GitHub can crash your life savings because they forgot to validate an input? And you call that freedom? In America, we don’t let toddlers play with live wires. Why are we letting people gamble with their entire net worth on code written at 3 AM by someone who thinks ‘reentrancy’ is a new Pokémon? This isn’t finance. It’s a dumpster fire with a whitepaper.

ashi chopra

December 7, 2025 AT 20:31 PMI’ve been watching this space for years, and I just want to say-I see you. The ones who lost money. The ones who stayed up all night debugging. The ones who still believe in this, even after the crashes. You’re not naive. You’re brave. And if you’re reading this? You’re not alone. Take a breath. Check your positions. And remember: your worth isn’t measured in APY.

Ivanna Faith

December 8, 2025 AT 23:57 PMY’all are overcomplicating this so much 😭 like just use 1inch and chill. Why are you even on Aave if you don’t know what a flash loan is?? I mean… if you’re still manually managing your positions in 2025?? Babe. It’s 2025. Let the bots do the work. I’m at 18% APY and I haven’t clicked a button since January. ✨

Akash Kumar Yadav

December 10, 2025 AT 03:02 AMIndia doesn’t need this chaos. We have our own financial systems. Why are we importing American crypto gambling as ‘innovation’? You think this is progress? This is digital colonialism wrapped in a whitepaper. Your ‘money legos’ are just casino chips with blockchain branding. We don’t need your unstable experiments. Build something real. Like rural fintech. Not this.

samuel goodge

December 11, 2025 AT 05:34 AMComposability, as a concept, is not new-think of Unix pipes, or modular software architecture. What’s novel is its application to capital. But here’s the philosophical tension: if every interaction is atomic, then agency becomes an illusion. Are you the actor… or merely the trigger? The system executes, but who bears moral responsibility when the chain collapses? The coder? The user? The oracle? The answer, I fear, is none of them-and that is the true tragedy.

Vidyut Arcot

December 12, 2025 AT 16:54 PMHey, if you’re new to this-start small. Pick one protocol you trust. Learn how it works. Then add one more. Don’t jump into leveraged yield farms. Don’t trust ‘1-click’ apps. I’ve seen too many people lose everything because they thought ‘high APY’ meant ‘safe.’ You’re not behind. You’re smart for asking questions. Keep going. You got this.

Jay Weldy

December 13, 2025 AT 13:55 PMI just want to say-this whole thing is beautiful. Even with the risks, the fact that a teenager in Lagos can build a financial tool that a bank in New York can’t replicate in a year? That’s the future. It’s messy. It’s loud. It’s imperfect. But it’s alive. And that’s more than I can say for most of traditional finance.

Melinda Kiss

December 14, 2025 AT 17:52 PMI’ve been using DeFi for three years now. I lost $1,200 in a bad liquidation. I cried. I didn’t give up. I learned. I now use only audited protocols, set custom slippage limits, and never touch anything under $500M TVL. It’s not glamorous. But I’ve made more than my 401k. And I sleep at night. You can too. Just be intentional.

Christy Whitaker

December 16, 2025 AT 03:29 AMWow. You really think this is sustainable? You’re not just naive-you’re dangerous. You’re encouraging people to gamble their life savings on code written by people who don’t even know what ‘liability’ means. And you call this innovation? It’s a Ponzi dressed in open-source clothing. And you? You’re part of the problem.

Nancy Sunshine

December 16, 2025 AT 15:12 PMWhile the technical merits of composability are undeniable, one must consider the epistemological implications of decentralized financial autonomy. The ontological shift from fiduciary intermediation to algorithmic mediation represents not merely a technological advancement, but a fundamental reconfiguration of economic subjectivity. The user, once a passive beneficiary of institutional safeguards, now assumes the role of an active, yet untrained, risk-manager. This transition, while empowering in theory, may precipitate widespread systemic fragility absent regulatory scaffolding.

Alan Brandon Rivera León

December 16, 2025 AT 20:18 PMMy dad’s in his 70s. He uses a DeFi aggregator to earn 7% on his savings. No brokerage. No fees. Just a simple app. He doesn’t know what a smart contract is. But he knows his money works harder now. That’s what matters. This isn’t about code. It’s about access. And that’s worth fighting for.