Crypto Enforcement Operations Comparison Tool

Compare Crypto Enforcement Operations

Select one or more operations to see key details side-by-side

Key Takeaways

- Operation Final Exchange hit 47 Russian‑language no‑KYC exchanges in a coordinated BKA raid.

- Authorities seized over 8 TB of server data, including user registrations, transaction logs and IP addresses.

- The takedown combined technical depth (all dev, production and backup servers) with a psychological warning to users.

- Compared with past actions like the ChipMixer seizure, Final Exchange was larger in scope but narrower in geographic focus.

- Industry analysts see the operation as a template for future multi‑jurisdictional crypto enforcement.

When the German Federal Criminal Police (BKA) announced Operation Final Exchange a coordinated seizure of 47 Russian‑language, no‑KYC cryptocurrency exchanges on September 19, 2024, the crypto world got its first real taste of a “all‑in” law‑enforcement strike. The message was blunt: “We have found their servers and seized them… See you soon.” Why does this matter for everyday traders, privacy fans, or anyone watching the regulatory tide? Let’s break down what happened, how it differs from past operations, and what it could mean for the next wave of crypto enforcement.

What Exactly Was Targeted?

The operation zeroed in on instant‑swap style platforms that let users trade Bitcoin, Ether and dozens of altcoins without providing a name, phone number or even an email address. In other words, these were classic no‑KYC exchanges services that skip identity verification, catering mainly to Russian‑speaking users. The 47 sites acted as direct fiat on‑ramps and off‑ramps for sanctioned Russian banks, creating a hidden bridge for money‑laundering, ransomware payouts, darknet drug sales and other illicit cash flow.

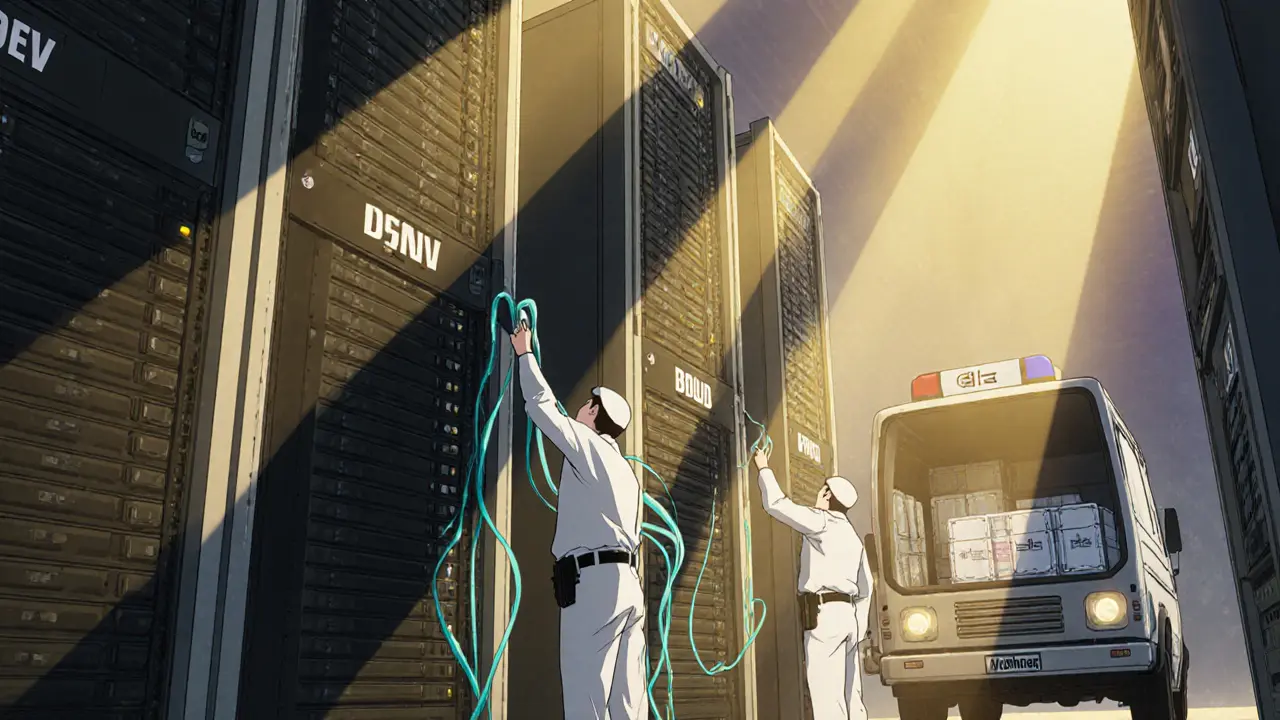

How the Raid Was Executed

What set Final Exchange apart was the breadth of the seizure. German agents didn’t just shut down the public front‑ends; they also seized:

- Development servers where new code was tested.

- Production servers hosting live trading engines.

- Backup systems that could have been used to spin the services back up.

All together, the operation harvested more than 8 terabytes of data-user registration blobs, transaction histories, IP logs and even internal chat archives. By taking the entire tech stack at once, the BKA blocked the usual “just jump to a new host” playbook that many previous takedowns missed.

Why the Psychological Message Matters

Alongside the technical strike, the BKA released a public warning directly to the exchanges’ user bases. The message quoted the seized data and warned that investigations were already underway. This “psychological warfare” element is rare; most enforcement actions simply announce the shutdown. Here, the authorities aimed to deter future users from hopping onto similar no‑KYC services by creating fear of personal exposure.

Comparison With Other Major Crypto Enforcement Actions

| Operation | Date | Targets | Data Seized | Primary Focus |

|---|---|---|---|---|

| Final Exchange | Sep 2024 | 47 Russian‑language no‑KYC exchanges | 8 TB (servers, logs, user data) | Sanctions evasion & money‑laundering |

| ChipMixer a Bitcoin mixing service that facilitated €90 million in illicit flows | Oct 2023 | 1 mixing platform | ~2 TB (mixing logs, IP data) | Obfuscating ransomware proceeds |

| FinCEN Sanctions Watch | Various (2022‑2024) | Multiple US‑based mixers & crypto services | Variable (case‑by‑case) | U.S. sanctions enforcement |

Compared with ChipMixer, Final Exchange was broader in the number of services hit, but narrower geographically-focused on Russian‑language platforms. The U.S.‑led FinCEN actions have a wider jurisdictional net but often lack the simultaneous multi‑server seizure that Germany pulled off.

Industry Reaction: Praise, Criticism, and Lessons Learned

Blockchain analytics firm Chainalysis a leading provider of cryptocurrency investigation tools called the operation “a showcase of how instant‑swap, no‑KYC services are the linchpin of on‑chain cybercrime.” Security researchers highlighted the technical sophistication required to locate, infiltrate, and seize the scattered server farms across multiple data centers.

On the flip side, privacy advocates warned that sweeping data grabs could ensnare innocent users who merely value anonymity. Reddit’s r/cryptocurrency threads reflected a split: some users applauded the crackdown as a step toward mainstream legitimacy, while others feared a chilling effect on privacy‑focused innovation.

What This Means for Future Crypto Enforcement

Four takeaways can guide anyone watching the regulatory landscape:

- Multi‑server seizures cripple recovery. Taking dev, prod, and backup systems at once leaves criminals with no quick rebuild path.

- Data‑heavy raids provide a goldmine for investigations-authorities can trace thousands of transactions and link wallets to real‑world identities.

- Psychological messaging amplifies deterrence. Public warnings make potential users think twice before using a no‑KYC service.

- International cooperation is non‑negotiable. The BKA coordinated with Frankfurt prosecutors and foreign partners to navigate jurisdictional hurdles.

Analysts from Duane Morris an international law firm tracking crypto regulation predict that EU member states will adopt similar all‑in‑one takedown powers within the next two years, especially as sanctions against Russian assets tighten.

Potential Risks and Adaptive Strategies for Criminals

Criminal actors aren’t idle. After Final Exchange, forums reported a surge in interest for decentralized, peer‑to‑peer swapping protocols that don’t rely on centralized servers. Projects like Atomic Swaps and emerging Layer‑2 privacy mixers could become the next targets. Law‑enforcement agencies will need to evolve, focusing more on blockchain‑level analytics rather than server raids alone.

Bottom‑Line Checklist for Anyone Running or Using Crypto Services

- Know the KYC policy of any exchange you use-no‑KYC platforms now sit on the radar of multiple agencies.

- Keep transaction histories minimal; once data is seized, authorities can map every on‑chain move.

- If you’re a service operator, implement robust legal compliance programs-early cooperation can reduce penalties.

- Stay informed about EU and German regulatory updates; the compliance market is already a $1.2 billion industry.

Frequently Asked Questions

What was the main goal of Operation Final Exchange?

The operation aimed to cripple a network of Russian‑language, no‑KYC crypto exchanges that were funneling money for sanctions evasion, ransomware payouts and other illicit activities by seizing their entire server infrastructure and data.

How does this raid differ from the ChipMixer seizure?

ChipMixer targeted a single mixing service, while Final Exchange hit 47 platforms at once and took every backup and development server, making rapid re‑launch far harder.

Will other EU countries copy Germany’s approach?

Legal analysts expect similar all‑in‑one seizure powers to be adopted across the EU, especially as sanctions against Russian entities remain a priority.

Are legitimate privacy‑focused users at risk?

Yes, any user of the seized platforms could see their data handed over to investigators, even if they never engaged in wrongdoing.

What role did blockchain analytics firms play?

Companies like Chainalysis provided tracing tools that linked wallet addresses to the seized servers, turning raw blockchain data into actionable intelligence.

Operation Final Exchange is a clear signal that governments are ready to go beyond simple exchange licensing and pull the plug on entire illicit ecosystems. Whether you’re a trader, a developer, or just a crypto‑curious observer, staying informed about these enforcement trends is now part of the crypto playbook.

BRIAN NDUNG'U

October 23, 2025 AT 08:11 AMThe operation underscores how coordinated law enforcement can dismantle illicit infrastructures. It serves as a reminder that compliance is not optional for any service provider. Stakeholders should take proactive steps to audit their KYC procedures. Ultimately, a collective effort will safeguard the ecosystem.

Donnie Bolena

November 6, 2025 AT 01:51 AMWow, what a massive bust, folks! This shows that no‑KYC platforms aren't invisible, they’re right in the crosshairs, and the authorities are getting smarter every day! Keep your eyes peeled, stay informed, and remember: the crypto world can be wild, but it's also evolving!

Elizabeth Chatwood

November 19, 2025 AT 20:32 PMThe German raid really changed the way we think about crypto enforcement. It hit dozens of exchanges that were basically invisible to anyone without a phone number. The fact that they seized every server even the backup ones means the operators cant just spin up a new site tomorrow. From a trader perspective this is a huge warning sign that using no kyc services is risky. Many people didnt realize that their transaction data could be grabbed and handed to investigators. The operation also sent a public message that the police are watching the crypto space closely. This psychological angle is something we havent seen a lot before in crypto busts. If you are using a platform that doesnt ask for ID think twice about the long term consequences. The data haul of over eight terabytes is massive and will keep analysts busy for months. Chainalysis and other firms will probably map thousands of wallets to real world identities. That level of detail could make it easier to trace ransomware payouts back to the original hackers. At the same time privacy advocates are worried that innocent users will get caught in the net. It is a fine line between fighting crime and overreaching into legit privacy needs. Regulators in the EU are likely to use this case as a template for future actions. If more countries adopt similar powers we might see a wave of all in takedowns across the continent. Overall the crackdown sends a clear signal that anonymity is no longer a safe harbor for illicit activity.

Tom Grimes

December 3, 2025 AT 15:12 PMHonestly I feel uneasy reading about how deep the raid went. The servers were taken, the data was copied, and the users were left in the dark. It reminds us that even simple services can hide complex operations. The fact that the authorities acted so quickly shows they have been watching for a while. A lot of people will wonder if their own wallets are exposed now. The whole scene feels like a thriller but with real consequences. We should all stay alert.

del allen

December 17, 2025 AT 09:53 AMI totally get the fear here :( using no‑kyc sites felt safe but now it looks like a big risk. My buddy was using one and didnt think twice. Its scary to imagine all that data in police hands. Hope we all learn from this and pick safer platforms. Stay safe out there!

Jon Miller

December 31, 2025 AT 04:33 AMMan that’s a plot twist worthy of a Netflix binge! No‑KYC exchanges thought they were untouchable, and boom – German police drop the hammer. Can’t wait to see what the next episode comes.

Rebecca Kurz

January 13, 2026 AT 23:14 PMThe whole thing smells like a coordinated push by the shadow banks, doesn’t it? They want us to think it’s just about crime, but they’re probably gathering intel on every crypto user! Every server they took holds keys to our financial freedom! Keep your wallets tight, the watchful eyes are everywhere! Trust no one!

Nikhil Chakravarthi Darapu

January 27, 2026 AT 17:54 PMThe operation demonstrates the effectiveness of sovereign law enforcement against foreign illicit actors. Germany has acted within its jurisdiction to protect national financial stability. Such decisive action should be applauded by all who value order.

Tiffany Amspacher

February 10, 2026 AT 12:35 PMIsn’t it fascinating how a single raid can echo through the blockchain like a ripple in a pond? We chase freedom, yet the chains of regulation keep tightening. Maybe the true freedom lies not in anonymity, but in the wisdom to navigate the shifting sands of law.