SHM Staking Calculator

Shardeum's dynamic supply model mints new SHM exclusively as rewards for validators. As per the article, the network aims for over 100,000 TPS with gas fees staying under a few cents even during heavy load. This calculator estimates your potential returns based on:

- Current SHM price and token supply dynamics

- Estimated APY based on validator participation

- Transaction fees (SHM) for network operations

- Dynamic supply mechanics (new tokens minted only for validation)

Enter your staking parameters above to see your rewards

Key Insights

As Shardeum matures, its dynamic supply mechanism adjusts inflation to secure the network. While the article mentions 249 million SHM were released at TGE, new tokens are only minted to reward validators - creating a potential deflationary pressure when combined with fee burns.

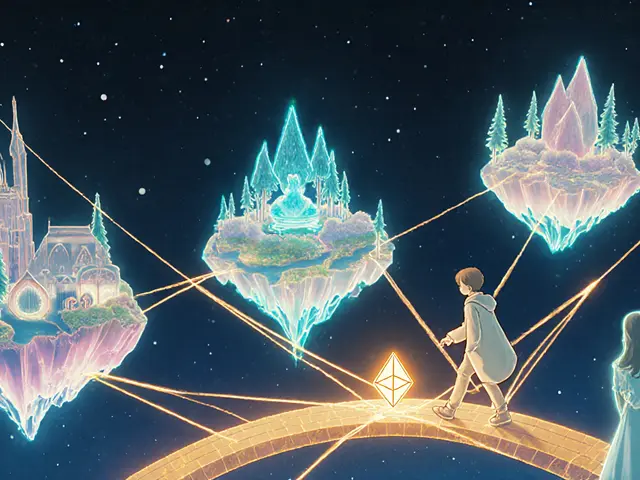

Ever wondered why gas fees on Ethereum can skyrocket while transaction speeds crawl? Shardeum aims to fix that by blending high‑throughput sharding with Ethereum‑compatible smart contracts. Below you’ll get a clear picture of the coin, the tech behind it, and what owning SHM actually means for you.

Key Takeaways

- Shardeum is an EVM‑compatible Layer 1 blockchain that uses dynamic state sharding to scale horizontally.

- Its native coin, SHM, powers transaction fees, staking, governance, and node rewards.

- Dynamic supply means new SHM is minted only to incentivize validators; token burning makes the supply potentially deflationary.

- Over 100,000 TPS is claimed, with gas fees staying under a few cents even during heavy load.

- SHM trades on exchanges like Bitget, KuCoin, LBank, and MEXC.

What is Shardeum?

Shardeum is a Ethereum Virtual Machine (EVM)‑based Layer 1 blockchain that uses dynamic state sharding to achieve high throughput while preserving decentralization and security. Launched publicly in 2023, the platform positions itself as a direct answer to the so‑called blockchain trilemma - the challenge of scaling, decentralizing, and securing a network at the same time.

The project’s native cryptocurrency, often referred to by its ticker SHM, serves multiple roles: paying gas, staking to become a validator, voting on governance proposals, and earning network rewards.

How Shardeum Works - Core Technology

At the heart of Shardeum lies the Shardus protocol, a proprietary suite that enables dynamic state sharding. Unlike static sharding, where the number of shards is fixed after launch, Shardeum’s approach automatically creates new shards as transaction volume spikes. This means the network can theoretically handle any load without the bottlenecks seen on single‑chain designs.

Each transaction is processed individually in a blockless fashion, which reduces finality time to a few seconds. Cross‑shard atomic composability guarantees that a smart contract call spanning multiple shards either completes fully or reverts entirely, preserving security.

Node architecture is also unique. The network distinguishes several node types:

- Validator nodes - secure the chain and earn newly minted SHM.

- Archive nodes - store the full history for explorers.

- Connector (RPC) nodes - provide APIs for dApp developers.

- Relayer nodes - stream data to off‑chain services.

- Monitor servers - keep an eye on network health.

The “standby nodes” concept ensures that as demand grows, enough validators are ready to join without a steep onboarding curve.

SHM Tokenomics

During the Token Generation Event (TGE) in early 2024, Shardeum released 249 million SHM. Unlike a fixed‑supply model, the token follows a dynamic supply mechanism: new coins are minted solely as rewards for validators who lock up SHM as collateral. This aligns token issuance with the network’s security needs.

Key attributes of SHM:

- Divisible to 18 decimal places, matching Ethereum’s precision.

- Used for transaction fees, staking, governance voting, and reward distribution.

- Burn mechanisms (e.g., a portion of fees) reduce circulating supply over time, creating a deflationary pressure.

Because minting is tied to validator participation, the supply curve is expected to flatten as the network matures, potentially increasing token value if demand for staking grows.

Where to Trade SHM

SHM is listed on several mid‑size exchanges, giving investors multiple entry points:

| Exchange | Trading Pairs | Avg. 24h Volume | Liquidity Score |

|---|---|---|---|

| Bitget | SHM/USDT, SHM/BTC | $12 M | High |

| KuCoin | SHM/USDT, SHM/ETH | $9 M | Medium‑High |

| LBank | SHM/USDT | $3 M | Medium |

| MEXC | SHM/USDT, SHM/BTC | $2 M | Medium |

All listed platforms support standard EVM wallets (MetaMask, Trust Wallet, etc.), so you can move SHM without learning a new UI.

Use Cases & Ecosystem

Because Shardeum is EVM‑compatible, any existing Ethereum dApp can be redeployed with just a change of RPC endpoint. Developers have started building DeFi primitives-automated market makers, lending protocols, and yield farms-that benefit from sub‑cent gas fees.

Beyond DeFi, the platform’s linear scalability opens doors for data‑intensive workloads like AI model marketplaces or high‑frequency trading bots that need thousands of transactions per second.

Community‑governed funds, airdrop programs, and incentivized testnets have attracted a growing pool of validators. As of October 2025, over 150,000 SHM are staked across roughly 8,000 active validators.

Pros, Cons & Risks

Pros

- Scales horizontally-potentially unlimited TPS.

- Low, predictable gas fees even under load.

- EVM compatibility reduces migration friction.

- Dynamic token supply aligns incentives with security.

Cons

- Newer than Ethereum; real‑world performance still under observation.

- Dynamic supply adds complexity to price forecasting.

- Validator requirements may increase as shards multiply, raising entry barriers.

Risks

- Competing Layer 1s (Solana, Avalanche, Polygon) also claim high throughput; market share is not guaranteed.

- Smart‑contract bugs could propagate across shards if not properly isolated.

- Regulatory uncertainty around staking rewards in some jurisdictions.

Frequently Asked Questions

What does SHM stand for?

SHM is the ticker symbol for the native Shardeum token, often called “Shard”. It is used for gas fees, staking, and governance.

Is Shardeum really EVM‑compatible?

Yes. Developers can deploy any Solidity contract on Shardeum without code changes, just by pointing their wallet to the Shardeum RPC endpoint.

How are new SHM tokens created?

New SHM is minted exclusively as rewards for validator nodes that lock up the token as collateral. No additional mining or fixed inflation schedule exists.

Can I use a regular MetaMask wallet on Shardeum?

Absolutely. Add the network manually using the RPC URL provided on the official Shardeum docs, and your existing MetaMask accounts work out of the box.

What are the biggest competitors to Shardeum?

Layer 1s like Solana, Avalanche, Polygon, and the upcoming Ethereum upgrades (sharding, rollups) all aim for similar scalability goals. Shardeum’s edge is its fully dynamic sharding combined with Ethereum compatibility.

Bottom line: if you’re looking for a blockchain that promises high speed, cheap fees, and a familiar dev environment, Shardeum is worth watching. As the network matures, token dynamics and real‑world performance will decide whether SHM becomes a staple in any crypto portfolio.

Sara Stewart

February 12, 2025 AT 02:55 AMShardeum’s dynamic state sharding is a game‑changer for throughput; the protocol spins up new shards on‑demand as transaction volume spikes, which means the network can keep up with DeFi carnage without hitting a hard ceiling. By staying EVM‑compatible it lets devs port existing Solidity contracts with a simple RPC switch, preserving tooling and audit pipelines. The validator incentive model mints SHM proportionally to staked collateral, aligning security with tokenomics in a neat feedback loop. Gas fees stay in the sub‑cent range because each shard processes its own mempool, slicing the congestion that plagues Ethereum’s L1. In practice, real‑world TPS numbers still need broader validation, but the architecture is solid on paper.

Laura Hoch

February 23, 2025 AT 17:19 PMReading through the tokenomics, I can’t help but see a micro‑cosm of the broader blockchain philosophy: supply should be tethered to utility, not arbitrary inflation. The dynamic mint‑and‑burn mechanism mirrors a living organism, where new SHM is only “born” when validators stake, and fees are the metabolic waste that gets recycled. It’s a thoughtful design that respects both security and scarcity, even if the math gets a little messy for casual investors. Still, the community‑governed fund adds an extra layer of shared stewardship that feels almost… poetic. As we watch the ecosystem mature, the real test will be whether that scarcity translates into genuine market demand.

Devi Jaga

March 7, 2025 AT 10:30 AMOh great, another “unlimited TPS” claim. Sure, Shardeum will magically sprout shards like mushrooms after a rainstorm, and gas will stay at a few cents forever. In reality, the validator onboarding requirements might become a bottleneck the moment the network tries to scale.

Hailey M.

March 18, 2025 AT 22:07 PMWow, you really think the sharding fairy will sprinkle free TPS on us? 🙄✨ Yeah, the idea sounds like a sci‑fi plot twist, but the actual implementation still needs serious node diversity. Still, the low‑fee promise does make the spec sound like a dream for gamers and traders alike. Maybe we’ll see a wave of meme‑coins hopping onto Shardeum once the hype settles. 🌊🚀

Vinoth Raja

March 30, 2025 AT 16:18 PMHonestly the whole dynamic sharding thing sounds slick but I’m still waiting on solid benchmarks from real‑world dApps. If the network can keep finality under 5 seconds while handling 10k TPS, that would be a big win. The EVM bridge is a nice shortcut for devs, no need to rewrite contracts. I guess we’ll see how the validator pool grows as the shards multiply.

Kaitlyn Zimmerman

April 11, 2025 AT 09:28 AMYeah I think the bridge will help a lot more people move over because they don’t have to learn new languages also the low fees could attract small traders who usually stay on centralized exchanges

Chris Morano

April 23, 2025 AT 02:39 AMShardeum definitely has the right ingredients to shake up the L1 space. The combination of cheap gas and familiar tooling could lower the barrier for countless projects. I’m hopeful we’ll see a vibrant ecosystem develop over the next year.

Ikenna Okonkwo

May 4, 2025 AT 19:49 PMExactly, the ecosystem potential is huge, especially if more DeFi protocols start experimenting with cross‑shard composability. When validators are incentivized properly, security should scale alongside throughput, which is a win‑win for users and developers alike.

Bobby Lind

May 16, 2025 AT 13:00 PMSounds promising, but time will tell.

Marina Campenni

May 28, 2025 AT 06:10 AMIt’s easy to get swept up by the hype surrounding any new Layer‑1 that promises high throughput, but a measured approach is essential when evaluating Shardeum’s long‑term viability.

First, the core concept of dynamic state sharding addresses a genuine limitation of static shard designs, offering the ability to adapt to fluctuating demand without manual reconfiguration.

Second, maintaining full EVM compatibility means that developers can migrate existing Solidity contracts with minimal friction, preserving the investment they have already made in tooling and audits.

Third, the tokenomics model, which ties new token issuance directly to validator participation, creates a clear economic incentive to secure the network while also limiting uncontrolled inflation.

Fourth, the built‑in burn mechanism, which consumes a portion of transaction fees, provides a deflationary pressure that could support price appreciation if adoption grows.

Fifth, the diversified node architecture-including validators, archive nodes, connectors, relayers, and monitors-helps distribute responsibilities and can improve overall network resilience.

Sixth, the current list of exchanges such as Bitget, KuCoin, LBank, and MEXC gives SHM reasonable liquidity, reducing the barrier for new investors.

Seventh, the community‑governed fund and airdrop programs demonstrate an intention to involve stakeholders in decision‑making, which can foster a healthier governance ecosystem.

Eighth, real‑world use cases beyond DeFi, such as AI model marketplaces and high‑frequency trading bots, illustrate the flexibility that high TPS can unlock.

Ninth, the reported validator count of around 8,000 and staked SHM of 150,000 indicate that the network already enjoys a decent level of decentralization, though this will need to scale with demand.

Tenth, the competitive landscape, featuring established players like Solana, Avalanche, and Polygon, means Shardeum must continuously innovate to retain market share.

Eleventh, regulatory considerations around staking rewards remain a variable that could affect participation in certain jurisdictions.

Twelfth, the absence of major security incidents to date is encouraging, yet thorough third‑party audits and continued monitoring are vital.

Thirteenth, the roadmap’s emphasis on improving cross‑shard atomic composability could unlock more complex smart‑contract interactions.

Fourteenth, the community’s active presence on forums and social media provides a valuable feedback loop for developers.

Finally, while the technical blueprint is compelling, the ultimate test will be sustained developer adoption and user growth over the coming months.

Nick O'Connor

June 8, 2025 AT 23:21 PMIndeed, the architecture looks solid, the tokenomics are thoughtfully designed, and the community engagement is impressive; however, the real challenge lies in achieving consistent, large‑scale adoption, and only time will reveal whether Shardeum can truly differentiate itself from the crowded L1 arena.